In short and simple words, alligator indicator helps you to show the market is in trend or not. Generally, 20% to 30% of the time market is in trend rest 70 to 80% time market is sideways.

This indicator is like an alligator when alligator eats something that time alligator will open mouth. That means the market is in trend.rest of the time is alligator is sleeping so that means the market is sideways.

Most of the people make Money in trending market. So many traders wait for trending market.

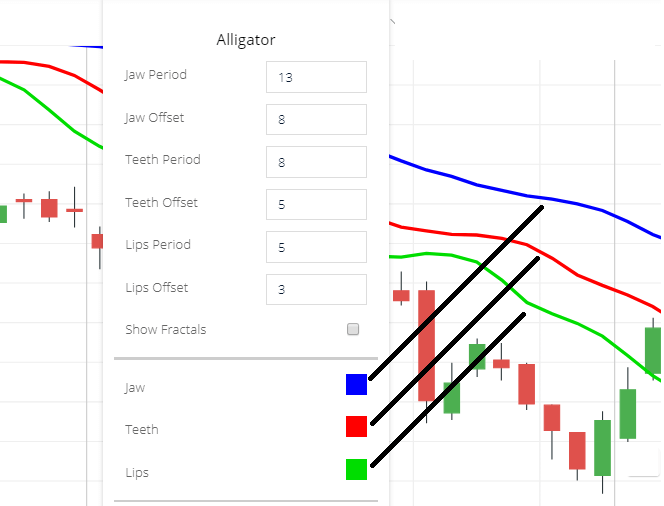

alligator indicator Setting

Go to studies and search for alligator

- Jaw Period: Jaw periods number needs to calculate jawline. Here 13 period means 13 candle closing price will need to calculate.

- Jaw offset: this is the jawline distance from the actual jawline simple Moving average. You can Increase or decrease jaw line offset distance.

- Teeth period: Teeth period number needs to calculate the teeth line. Here 8 period means 8 candle closing price will need to calculate.

- Teeth offset: this is teeth line offset distance.

- Lips period: Lips period number needs to calculate lips line. Here 8 period means 8 candle closing price will need to calculate.

- Lips offset: lip line offset distance.

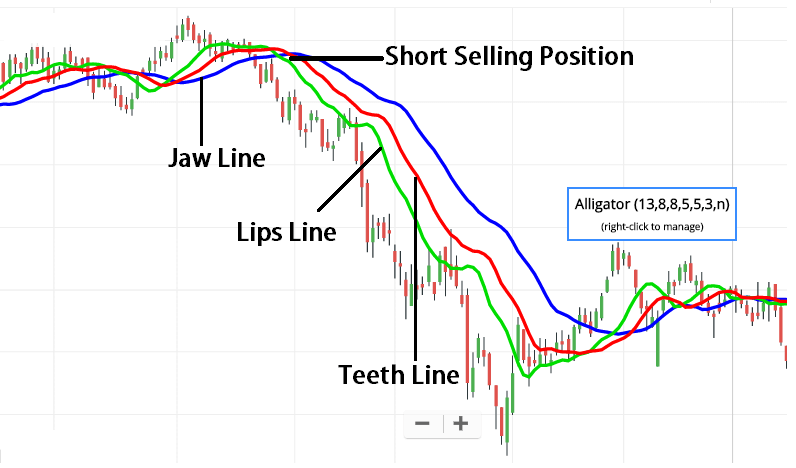

- Jaw: Jaw line color( blue line).

- Teeth: teeth line color( red line).

- Lips: Lips line color ( green line).

Calculation

By default trading software automatically calculate this indicator. Not need to calculate manually. Still I’m sharing little information about calculation.

- Jaw Line is smoothed moving average, 13 periods ( candle) and smoothed by 8 periods( candle)

- Teeth Line is smoothed moving average, 8 periods( candle) and smoothed by 5 periods( candle)

- Lips Line is smoothed moving average, 5 periods( candle), and smoothed by 3 periods( candle).

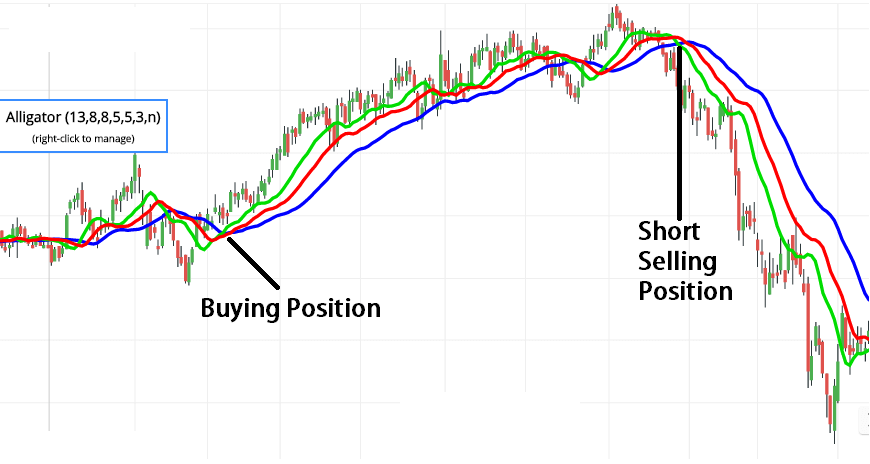

Alligator indicator trading strategy

Strategy 1

This indicator will narrow when the market isn’t in trend. Or when this indicator started narrow after the Trending market. That means the Trending market maybe end.

When lips crossing down then short sell position created. When life crossing upward direction then buying position created according to this indicator.

Strategy 2

Use this indicator with combinations with RSI indicator.

When the Alligator indicator is giving a buying or selling signal then you can check the signal in the RSI indicator.

in the RSI indicator, if the RSI is above the 50 level, this means bullish signal and when the RSI is below the 50 level this means bearish signal.

- when the Alligator buying signal matches with the RSI bullish signal then you can buy the stock.

- when the Alligator selling signal matches with the RSI bearish signal then you can sell the stock.

Conclusion

The Alligator indicator is a useful indicator. It’s will work on the trending market. This indicator finds short sell opportunity and buying opportunity for traders. Also, this will help when the trending market is ending.

*Read Related Post for more information.