Often we think about how big pocket investors buy or sell shares, also how to get that transaction data. actually they buy or sell big quantities of stocks by block deals & bulk deals.

What is block deal?

This is a trade where minimum 5 lakh shares or minimum 5 cr amount of shares transaction between two parties in a single trade within 9.15 am to 9.50 am.

Block deal executed in the separate trading window and this window open for 35 minutes (9.15 am to 9.50 am) in the morning trading days.

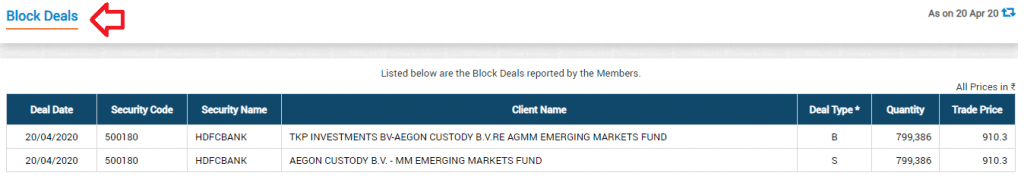

Block deal orders are disclosed by the stock exchanges on the public where the Client name, quantities of trade, the average price of the trade.

When two parties agree to buy and sell a minimum 5 lakh or minimum 5Cr amount shares transaction in a separate window. block deal order trading not visible to the normal trading window.

Indian stock market regulator SEBI set rules that trading price should be in a range +1% or -1% of the current price.

What is bulk deal?

Bulk deal trade executed in the normal trading window throughout the trading hours where traders brought and sold 0.5% of the company shares.

It is executed in the normal trading window by brokers. the order is visible in the normal trading window.

bulk deal can execute throughout the day by multiple trading and after executed the trading have to inform stock exchanges.

Traders buying or selling 0.5% shares in the open market so it can change stock prices.

How to get Data of block & bulk deals data?

Visit the official website of stock exchanges NSE (National stock exchange) & BSE (Bombay stock exchange).

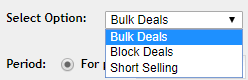

To see NSE(national stock exchange) block and Bulk deal data visit nseindia.com

NSE Data

See BSE( Bombay stock exchange) data from bse.com

Why investors check block & bulk deal data?

Big investors, Fund houses, Institutional investors, HINs( high net worth individuals) Generally buy big quantity of shares by block deal & bulk deals.

If big investors buy a stock that means share prices generally rise.

Big investors do lots of research before investing to stock so there is a possibility of the company that can grow up in the long term.

Difference between Block deal and bulk deal:

| Types | Block deal | Bulk deal |

| TradingTime | 9.15 am to 9.50 am (35 minutes) in the morning trading hours. | Throughout the whole trading hours.No fixed time. |

| Trading Window | Execute in a separate trading window. | Execute in the normal trading window. investors buy from the open market |

| Quantities of shares | minimum 5 lakh shares or minimum 5 Cr amount of share | Minimum 0.5% share of the company |

| Parties | This transaction between two Parties when they agree to buy and sell. | Investors can buy or sell a share from the market. |

| Price | Stock market regulator SEBI set rules that price range should be in +1% or -1% of the current market price. | No fixed price, deal execute at market price. |

| Visibility | It Will not visible to the Normal trading window. | It will visible to the normal trading window. |

| View Data | View block deal data from nse block deals. then change option bulk deals to block deals. View block deal data from bse block deals. | View bulk deal data from nse bulk deals. View bulk deal data from bse bulk deals. |

Similarities Of block deal and bulk deal:

| Types | Block deal | Bulk deal |

| Trading Data | After closing the market the market. you get all data from Stock exchanges official websites. | Similarly, stock exchange websites will publish All data. |

| Stock Market | National Stock exchange(NSE) and Bombay stock exchanges(BSE) | Similarly, NSE and BSE |

*Read Related Posts For More Information.