The Price Rate of Change (Price ROC or PROC) helps to trade in the range-bound market. Also, you can use this indicator in a trending market but you have to use trend following indicator to follow the trend. Then you can trade in a trending market.

It’s measured by the current closing price and n closing price of the n period ago.

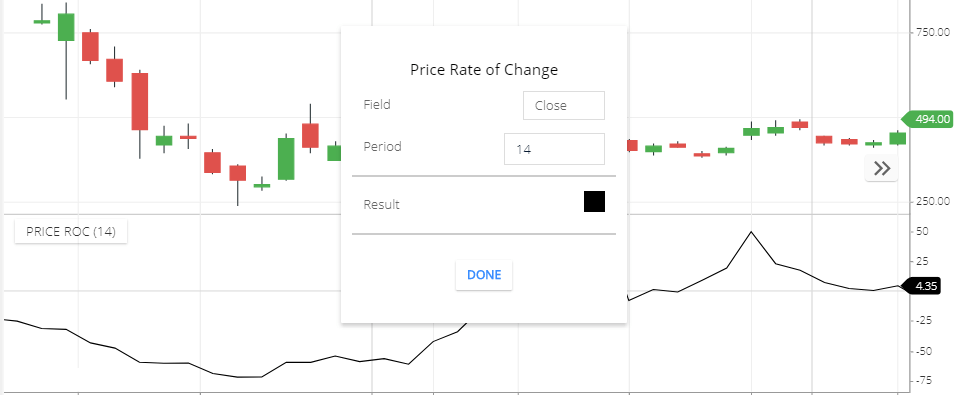

Price Rate Of Change Setting

- Field: as I already wrote above that, this indicator takes the closing price of the period to calculate this indicator. By default, the field is ‘close’. close means the closing price. the period close price needs to calculate the PROC indicator line. Other field types also available like opening price, period high price, low price, etc available. My recommendation to use the default field.

- Period: also have written above that, this indicator measure by the closing of the n Period ago. This is the n value. The default n value is 14. Means closing price of 14 Period ago will need to calculate this Indicator.

- Result: this is the ROC Indicator line color setting.

Price ROC Calculation

price rate of change formula = {(Current closing price – Closing price n period ago)/closing price n period ago}× 100.

Price Rate of changes trading strategy

Strategy 1

You can use this Indicator in the range-bound market rather than using in trending market.

- When the share price is moving down after reaching the peak point of the indicator. This may be an overbought position and if the indicator falling then, take short sell Position.

- When the share price is moving upward direction after reaching the oversold point. This may be a price reversal. Take buy Position.

- Or when Price ROC is moving to upward direction after Crossing the zero line. Buying Signal generated.

- When Price ROC is moving in a downward direction and after crossing the zero line. You can short sell the share.

Strategy 2

In the trending market, you can use MACD Indicator with this Indicator.

Buy Signal: in the Price rate of change Indicator, if the share price is Moving up and after crossing the zero line is the buying signal.

In the MACD Indicator, if the MACD line crossing the signal line and moving above the zero line. Is the buying Signal.

So, when both Indicators giving buying Signal, then buy the stock.

Sell Signal: in the Price rate of change indicator, if the PROC indicator line is moving Downward side, after Crossing the zero line, Below the zero line is the short-selling signal.

In the MACD Indicator, if the signal line crossing MACD line, and moving down, after crossing the zero line. Below the zero line is the selling signal.

When PROC and MACD both the indicator giving buying Signal. Then go for Selling

Conclusion

Price rate of change indicator calculated by closing price and closing price n period ago. It helps you to trade in a range-bound market, also in the Trending market with the help of trend following indicator.

*Read Related Posts for more information.