Chande Forecast Oscillator (CFO) indicator has moved around the ‘zero’ line. Whenever This indicator moves above the ‘zero’ line, this means, the Forecast price is above the current share price. So that this is the buying signal.

And whenever the CFO indicator moves below the ‘zero’ line, this means the forecasted price is below the current share price.

CFO indicator is the difference between the closing price of the share and certain period linear regression forecasted price.

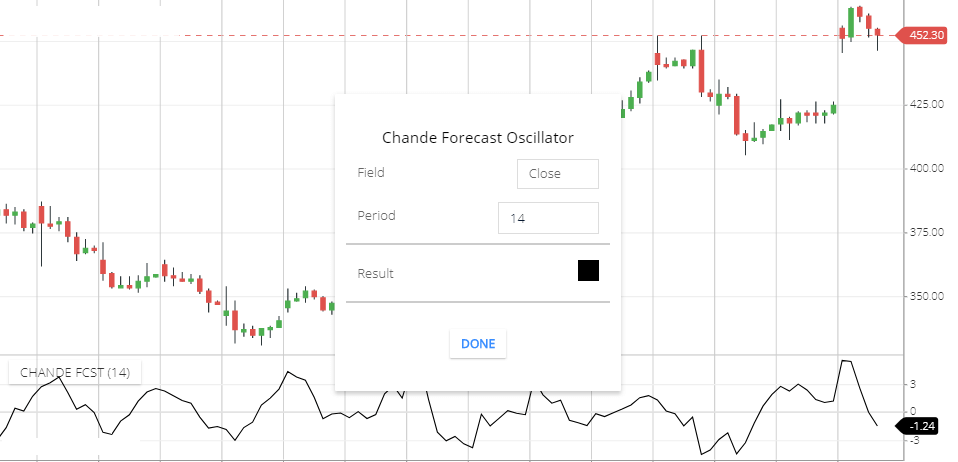

Setting

Go to indicator search section and search for “chande Forecast oscillator”

- Field: by default field is ‘Close’ which means periods closing price will take to calculate this indicator.

- Period: by default it’s 14 periods, period means each candle or bar of share price movement. So here indicator calculates with 14-period price activities.

- Result: This is the indicator line color.

Chande Forecast Oscillator tells you,

- buy and sell single.

- When the Forecasted price is higher than the closing price. Then CFO will be above the ‘zero’ line.

- when the forecasted price is lower than the closing price, then CFO will be below the ‘zero’ line.

Chande Forecast Oscillator Trading strategy

If stock trading at the top position for a short period of time and then falling down. In this situation you can Exit your buying position. And you can short sell.

If stock price reserving after bottom out then you can exit from short sell position & this is the buy signal.

For intraday trading CFO is helpful, you can buy when CFO line crossing the ‘zero’ line and going upward direction. and when the CFO line is crossing the ‘zero’ line & moving in a downward direction.

But for long term trading, if the share price isn’t breaking the previous support zone then you can stick to the stock. if share price breaks previous support. then you can exit from the stock.

Conclusion

Chande Forecast oscillator Indicator line moving upward and downward. If CFO goes to the upward direction this means buying signal & If CFO goes to a downward direction this means selling signal.

My view is using chande fcst indicator is, most of the Chande fcst indicator is giving signal whether to buy or sell.

*Read Related Posts For More information.