Pring’s know sure thing ( Pring KST) indicator is the momentum Oscillator that helps you to reduce false momentum. It takes 4 different time frame price & calculates the overall momentum of the share price.

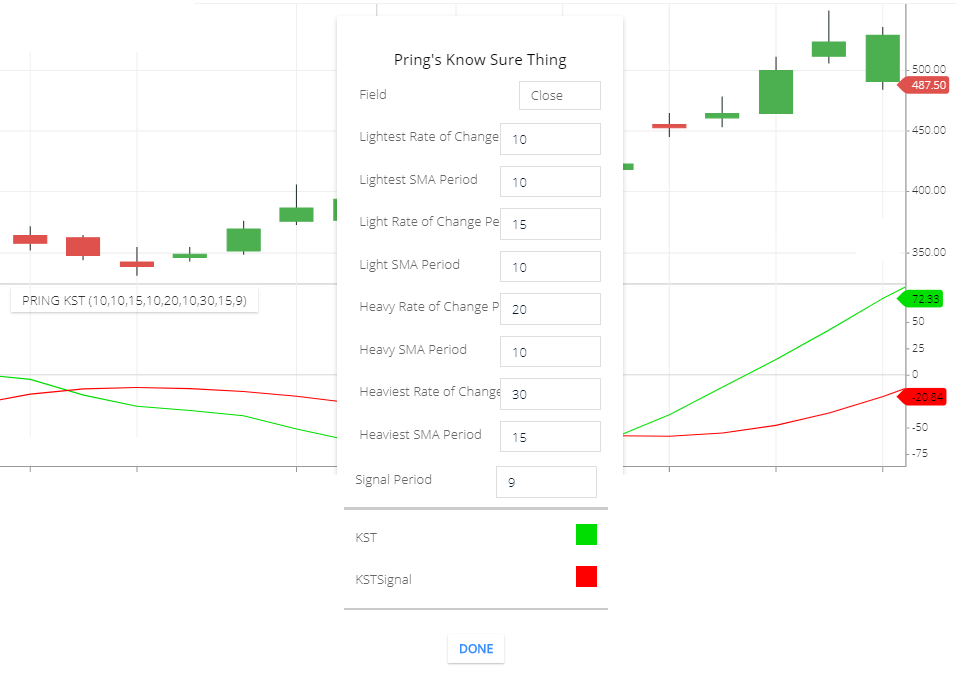

Pring’s Know Sure Thing Setting

- Field: The default field is ‘close’. This Means period closing price will take to calculate this Indicator. Also other types of fields available like opening price, high, low.

- Lightest Rate of change period: this is the lightest ROC period. The default value is 10.

- lightest SMA period: lightest SMA period, default SMA period is 10. This means that the calculation of 1st-time frame is. 10-period SMA of the 10 periods ROC.

- Light rate of Change period: Light ROC period will combine with Light SMA to calculate second-time frame value. Light ROC default period is 15.

- light SMA period: default value of Light SMA Period is 10.

- Heavy rate of change period: heavy ROC default period is 20.

- Heavy SMA period: heavy SMA default Period is 10.

- Heaviest rate of change period: Heaviest ROC default value is 30.

- Heaviest SMA Period: The heaviest SMA default period is 15.

- Signal Period: This is the signal line period. The default period of the signal line is 9.

Pring’s Know Sure Thing Calculation

The indicator uses 4 SMA and 4 ROC period value. So the formula will be

- Lightest SMA, ROC value = 10 periods SMA of the 10 periods ROC.

- Light SMA, ROC value = 10 Period SMA of the 15 periods ROC.

- Heavy SMA, ROC Value = 10 period SMA of the 20 Period ROC.

- Heaviest SMA, ROC Value = 15 Period SMA of the 30 Period ROC.

Pring’s KST = (lightest sma ROC value×1) + (light SMA ROC value × 2) + (heavy SMA ROC value ×3) + (heaviest SMA ROC Value ×4).

Signal line = 9 period SMA of the KST.

What KST Indicator tells you,

Sometimes technical indicators Give lots of false momentum signals. But if you enter to stock base on those false Signal. You can lose money. that’s why Pring’s Know Sure Thing used to reduce the false momentum of the share price. It measures different time frames Price momentum and tells you when strong momentum in the share price.

This Indicator oscillates above or below the zero line. Above the zero line is Bullish side and below the zero line is the Bearish side.

Pring’s Know Sure Thing trading strategy

Strategy 1

If the KST line is crossing the signal line, and moving above the zero line. This is the buying signal.

If the Signal line crossing the KST line and moving below the zero line, this is the short-selling signal.

Strategy 2

Use the RSI Indicator combination with this indicator.

In the KST Indicator.if the indicator line is crossing the signal line and after moving above the zero line. This is a buying signal in KST Indicator.

And in the RSI indicator, if the RSI line is Moving above the 50 level, this is a Bullish signal.

So, when both Indicator giving buy and Bullish signal. Then take a buying position.

Sell: if Pring’s Know Sure Thing gives you a short-selling signal. And in the RSI Indicator, the RSI line is moving down below the 50 level. This is the Bearish signal. When both the indicator Gives you selling and bearish signal. Then take the short-selling Position.

Conclusion

Pring’s know sure thing (Pring’s KST) helps to reduce the false momentum of the share price using multiple time frame price movements.

*Read Related Posts for more information.