The Swing Index Indicator is used to identify the short term trading signals means suddenly share price swing will indicate this indicator.

The accumulative swing index indicator also similar to this indicator. In the accumulative swing index indicate accumulation and distribution swing.

And the swing index indicator Indicates suddenly share price swing. This swing index indicator has three things which used to see the signals.

- Indicator line

- Zero Line

- And Right Side Numbers Bar.

- The line will oscillate around the 0 line. and there is no limitation of the oscillator line.

- The zero line is used to tells you the bullish and bearish side. above the zero line is a positive or bullish side. and below the zero line is the negative side or bearish side.

- And the right side number bar shows, the value of this indicator line.

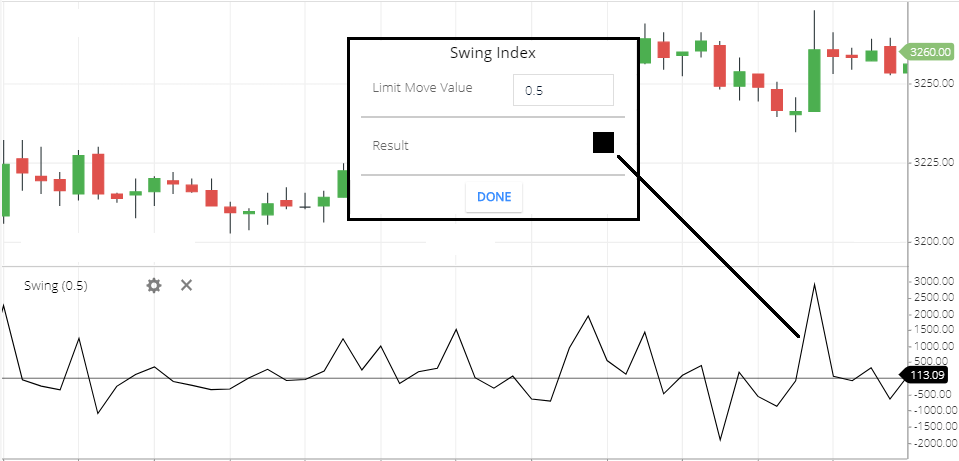

Swing Index Setting

- Limit Move Value: The default limit move value is 0.5. you can change the value then the right side number will change.

- Result: This is the Indicator line color setting.

what swing Indicator tells you

the indicator line generally moves around the zero line.

if the trend is bullish or bearish this indicator line will not help you. this will only detect, sudden spikes of the share prices.

If the share price suddenly rises Then this indicator line will move upward direction.

If the share price is suddenly falling. Then this indicator will move to Downward direction.

And rest of the time the indicator line is near the zero line no matter the trend is bullish or bearish.

Swing index Trading strategy

Buy strategy: If the indicator is moving above the zero line. This means the share price swing in the bullish side. Sometimes this is a bullish signal or sometimes just spikes. So to identify the trend you can use Supertrend indicator. If the share price is above the Supertrend line then if the swing index line moving above the zero line. You can take a buying position.

Sell Strategy: when the share price is below the Supertrend line, then if the swing index line is moving below 0. You can take a short sell position.

Note: this is not that easy to buy above zero and sell below zero line. because lots of the time the indicator gives you lots of weak buying and selling signals or false signals. and then the indicator line start reversing after entering to the stock that why

Conclusion

Swing index indicator is helps you to find the suddenly spikes or swing of the share price. above the zero line of this indicator is bullish swing and below the zero line is bearish swing.

To get trading signals use trend followng indicator with this.

*Read Related Post for more information.